INTRODUCTION

Omicron covid-19 numbers continue a downward trend across the GCC to manageable levels, with some countries relaxing their covid-19 restrictions as a result. UAE no longer requires a travel PCR test prior to entry into the Emirates and the wearing of face masks in public (outdoor) is no longer mandatory. All GCC countries require vaccination certification for entry and various protocols surrounding boosters also exist. Continued vaccination programmes takes 83% of the GCC into the herd immunity zone and 50% of the Arab coalition reaching well over a 100% of their population vaccinated. Collectively the GCC has managed the pandemic well and continues to reap the benefits to early lockdowns and strict covid-19 countermeasures, particularly the UAE.

The geo-political complexities here in the Middle East have taken on yet another dynamic as a result of the war in Ukraine. Both Saudi Arabia’s and UAE ‘s oil and political relationships with the world have currently positioned these countries in a unique predicament, firstly trying to keep OPEC+ partnerships intact (which includes Russia) and OPEC’s influence on global oil prices and secondly, staying on the right side of Washington. The reluctance of Saudi Arabia and UAE to release oil reserves to counter the short fall due to global sanctions against Russia may be viewed as taking sides. Current oil prices, highs not seen since 2008, will continue to benefit the GCC oil producers and their economies.

The non-oil sector impact of trade and investment, together with the impact of global sanctions against Russia and supply chains are yet to be felt, particularly in the areas of inflation where the GCC have done well in relation to other global economies.

GEO POLITICAL (SNAP SHOT MIDDLE EAST)

Both the UAE and Saudi Arabia continue with their neutral stance against the war in Ukraine and have resisted calls from Washington to release oil reserves onto the market as the West looks to impose sanctions against Russian oil supplies. The Gulf States are aligned to maintain the OPEC+ pact and their influence on global oil prices and its oil related relationship with Russia for the long term. Having said that, remaining neutral between the West and Russia given the unprecedented global response to Russian aggression, would not serve the Gulf countries well long term either.

Despite recent US military assistance against Houthi drone strikes against Dubai and Abu Dhabi the UAE decided (despite its insistence and recent acceptance onto the security council) to abstain on the vote called by the UN Security Council, in its condemnation of the Russian invasion; a move which could be interpreted in Washington to one of ‘are you with us or against us’. While both the UAE and Saudi Arabia governments have asked the Kremlin look for a peaceful resolution to the conflict, both countries continue to maneuver their way through the geo-political halls of global politics with confidence. The Saudi Crown Prince (MBS) playing the oil card to obtain recognition, support and weapons for his Yemen campaign from the US.

Ultimately Washington is relying on that neutrality eventually switching to one of support, given that, for the most part, America and the West remain the region’s security guarantor (example 1990-1991 invasion of Kuwait). Having said that, continued changes in US foreign policies (Obama, Trump & Biden) have changed GCC attitudes and the Arab countries, with growing political confidence, have started looking to the East (China) who would be more than happy to step in. Iran continues to support Russia, which is purely down to maintaining relationships for a post conflict era. Should the Iranian nuclear deal conclude later this month in Vienna and thus allow the lifting of sanctions on oil exports, would not only benefit the current short fall in global supply, help Iran’s frail economy, but could benefit Russia as an option to get its own oil onto the market via Tehran.

Iraq is another Middle East country refusing to condemn the invasion of Ukraine, a move is driven by Iran, given Iran’s influence in Iraq via its proxies (Shia Militias), testimony to Iran’s continued influence in the region. We now hear that Russia turns to Syrian mercenaries for its Ukraine fight, a move seen to reduce regular Russian troop casualties.

ECONOMIC SNAP SHOT

As oil prices rise to levels not seen since 2008 (7th March $126 a barrel) with forecasts for prices to increase further ($180 by end of 2022) given the long-term impact of the Ukrainian conflict and associated Russian sanctions. Gulf economies, while benefiting from the immediate hike in oil revenues remain neutral to the geo-political pressures not wanting to jeopardise the current OPEC+

agreement and bow to Washington’s demand to release oil reserves into the marketplace. Gulf tourism has rebounded faster than expected exceeding 2018-19 levels.

The decision by Goldman Sachs to relocate its Russian operations to Dubai and the extensive business event calendar in the UAE for 2022 continues to underpin the confidence investors have in the region. The main three Gulf economies (Qatar, Saudi Arabia & UAE) continue to make non-oil sector (manufacturing, PMI Index) gains and while most global economies register inflation rates of 5%-7% the GCC records inflation at 2% or lower.

While inflation rates will undoubtedly rise as a result of the Ukrainian conflict, oil supplies and supply chain interruptions, the GCC has the resilience and the economy to help fight the inflationary impact over both the short term and long term.

MIDDLE EAST NEWS

1. US F-22 squadron arrives to help UAE ward off Houthi attacks, France is also lending military support.

2. US approves $4.2 billion F-16 sale to Jordan, air defense systems to Gulf.

3. Energy markets are reeling with spikes in both oil and gas prices and a surge of instability related to the Russian invasion of Ukraine.

4. UN report and other worrying signs point to a likely surge in both an al-Qaeda and Islamic State presence in Afghanistan

5. Iraq: Iraqi armed faction Kataib Hezbollah (KH) has in recent weeks stepped up attacks on its enemies both inside and outside Iraq.

6. Iran said there are three main hurdles to overcome before Tehran can reach a new nuclear deal with world powers in Vienna.

7. Is Iran behind spread of Shiism in Gaza? Iran’s support for Hamas aims to spread Shiism in the Sunni-majority enclave.

8. The Israel Diamond Exchange opened an office in the United Arab Emirates’ largest city.

9. The financial technology sector in Turkey has grown significantly and is looking to Qatar for further expansion.

10. Iran: “The root cause of the Ukraine crisis is the US and the West’s policies,” Ayatollah Ali Khamenei said in a televised speech.

COVID-19 OVERVIEW (GCC)

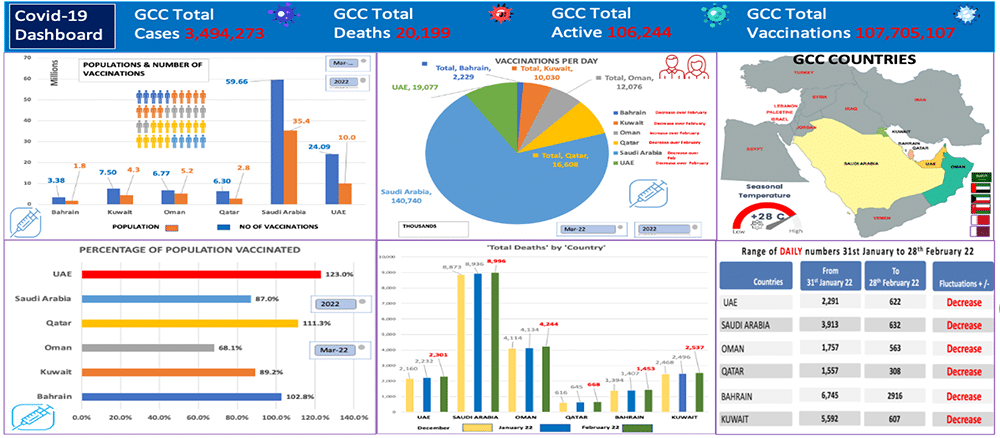

Omicron infection rates have significantly reduced over the month of February across all ofthe GCC states. The long term persistence of Covid-19 controls are having the desired effect over the recent new strain. Gulf authorities continue with their daily inoculation programmes, albeit slower than recent months with the exception of Saudi Arabia, who are still pushing hard delivering over 140, 000 inoculations a day in comparison to its neighbours.

The requirement for booster jabs for inter-gulf travel is becoming a standard requirement with validity dates ranging from 6 to 8 months after the second inoculation. Some residents in UAE are taking a fifth dose (2 x Sinopharm & 3 x Pfzer) in order meet some international travel requirements as some countries do not recognise the Chinese vaccine. However, GCC states do accept the combination of 2 x Sinopharm & 2 x Pfzer as sufficient to travel to other GCC states.

The UAE having brought recent Omicron numbers under control, maintaining a well-established booster programme and over 123% of its population inoculated, has decided to relax some of its pandemic countermeasures (1st March 2022). Wearing masks in public is no longer mandatory but remains in place for indoor venues and PCR tests are no longer required for travelers into the UAE, vaccination certification remain in place. Covid-19 restrictions are continually updated and vary across the Arab states and travelers are advised to seek advice before travel to the GCC.

The death rate in the GCC countries is low, ranging from one or two a day over the month of February. The milestone of herd immunity (75-80%) has been achieved by all except Oman who is currently showing 68.1% of its population inoculated.

SURROUNDING ARAB COUNTRIES TO GCC

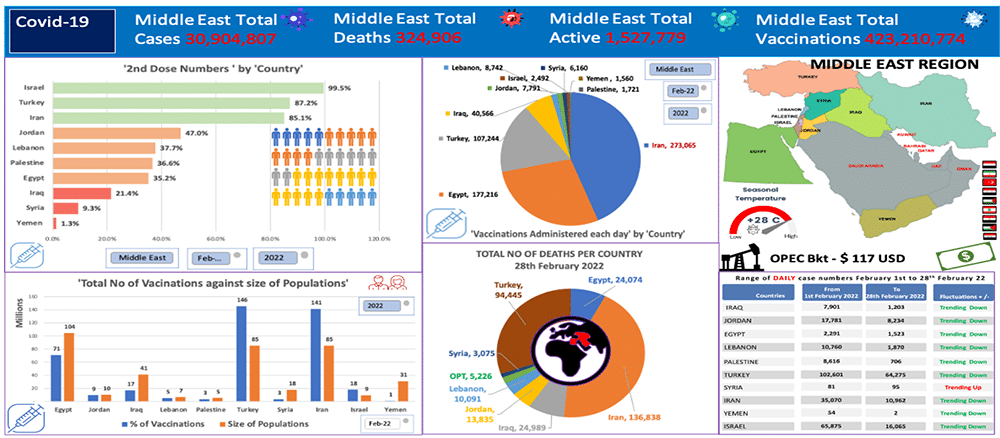

It’s a similar Covid-19 story within the surrounding Middle East countries with regards to the Omicron variant, all but Syria is trending downwards with their infection numbers. However, there are still some significant numbers of active cases within certain countries, such as Turkey and Iran (628,827 & 262,403 respectively), who have had long-standing issues in keeping these numbers down. Lebanon is particularly surprising with some 375,642 infections in the community at the end of February. Any meaningful Covid-19 recovery is being severely hindered by the economic, political and security situation Lebanon finds itself in, with no immediate solution on the horizon.

The vaccinated percentages of various Middle Eastern populations continue to rise slowly, with 7 out of the 10 countries featured in this newsletter still below 50% even after 2 years of the pandemic. Israel, Turkey and Iran are within the realms of herd immunity status with 99.5%, 87.2% and 85.1% respectively. However, Turkey and Iran struggle with high numbers of daily infections and continue to vaccinate large numbers 107,244 & 273,065 respectively on a daily basis. Egypt is inoculating over 177,216 people a day in their efforts to control its Covid-19 numbers and improve on its 35.2% of its population vaccinated. Apart from Iraq who inoculate over 40,000 people a day, the other 6 countries featured in the report range from 8,742 to 1,560 a day, all of which sit below the 50% of population vaccinated. Syria and Yemen being particularly hard hit in their ability to administer vaccines for obvious reasons (conflict zones).

Turkey’s death rate has increased from 5,317 total in January to 7,211 over the month of February, with a significant increase for Iran from 950 in January to 4,414 deaths in February. Israel and Egypt had close to 1500 deaths over February and the remainder of countries below 1,000.

Many countries featured in this report continue to struggle with their fight against the pandemic and data reaching back to the beginning of 2021 indicates painfully slow progress. A collective result of geo-political, economic and security influences that are uniquely intertwined and complex, will continue to hinder progress in these countries efforts to combat the pandemic.