INTRODUCTION

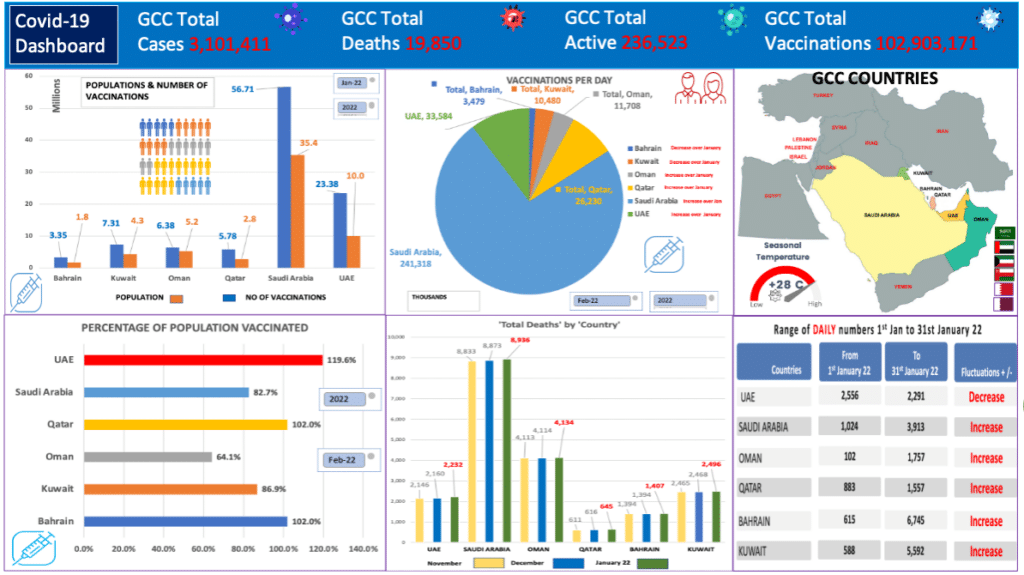

Gulf States including UAE, Saudi Arabia, Qatar and Oman are seeing infection rates come down towards the end of January. Kuwait and Bahrain are yet to turn that corner. Two of the GCC countries (Saudi Arabia and Qatar) are showing a steady decline in active cases within their communities, the remaining Gulf States remain particularly high. All but Oman (64.1%) boast strong percentages of populations vaccinated ranging from 82% to 119%. Varying levels of Covid-19 restrictions remain in place throughout the Region and in all of these countries the wearing of face masks in public is mandatory. The geo-political complexities of the region are ever present, recent missile attacks from Yemen on Abu Dhabi and Dubai are a result of assertive UAE foreign policy. Nuclear talks in Vienna are set to continue well into the first quarter between Iran and the world’s powers, with Tehran unrelenting in its defiant narrative with the West. With an unprecedented number of Arab countries normalising relationships with Israel, formally and informally, will continue to antagonise Iran and its proxies. Sampling of public opinion across the Middle East by experts indicate a high percentage of the Arab populous are not happy with the pan Arab-Israeli normalisation efforts by their governments.

The continued surge in oil prices is welcomed by Gulf economies, helping to quicken the economic recovery from pandemic expenses, stimulating public spending and increasing trade and foreign investment. This productivity underpins continuing assertive foreign policies by certain GCC member states, which in turn helps maintain their place on the world stage.

Tension in the Balkans, OPEC+ relationships, Turkey’s allegiances, affiliations, political interests and proximity to the Middle East, all have the potential to undo the economic positivity in the Gulf.

GEO-POLITICAL (SNAP SHOT MIDDLE EAST)

In the UAE, the new year has ushered in a spate of missile attacks from Houthi rebels in Yemen, which are linked to recent UAE military offences in Yemen and the strengthening of Israeli relationships. The Israeli President visited UAE despite Houthi missile fire. Iran is still locked in protracted negotiations with world powers in Vienna with the prospects of a longer and stronger nuclear deal for the West severely diminished. Tehran continues to take advantage of a weakened US foreign policy holding joint maritime exercises with Russia and China off the Iranian coast. A move aimed at developing long term relationships with obvious financial and security benefits for Iran. The US turns to Qatar to help mediate backchannel talks between the United States and Iran, a role historically undertaken by Oman (the Switzerland of the Middle East); a role that benefited the Gulf powerhouses in Riyadh and Abu Dhabi. Qatar’s recent success as a mediator (Afghanistan) and a Gulf security partner to the US is good optics for the region but doesn’t reassure Saudi and UAE having Doha in the room, given the recent rift between GCC states and Qatar. Turkey is another regional player affected by regional geo-political manipulation; Turkey’s inability to pay bills or its fence-mending with Israel are possibilities behind recent gas flow disruption into Turkey from Iran. In a similar vein, Turkish sales of its TBT 2 drones to Ukraine and its support of Ukraine’s desire to join NATO, puts pressure on its natural gas dependency, given Russia provides 33% of its natural gas supply. An emboldened Russia continues to push its foreign policies both in Europe and here in the GCC region, Syria remains a theatre for Russian combat experience for both ground troops and its pilots. Trade opportunities with Saudi Arabia along the lines of global oil production, Russian banks in Saudi, red sea shipping routes and pushing its missile defense system are testament to its relentless goals of expansion in the Middle East. Political turmoil continues in Iraq as wrangling continues over the makeup of the next government coalition. Iranian backed militia opposed to recent electoral changes continue their attacks in Baghdad (Green Zone, International airport) Anbar and the Kurdistan region using drones and missiles. Islamic State continues their efforts across Iraq and Syria showing complexity and operational maturity in their attacks, wiping out a whole Iraqi army outpost near Baghdad and staging Syrian prison break setting free IS prisoners. Kuwait is to take the lead in Gulf efforts to solve the Lebanon crisis as Hezbollah / Iran weigh up the next steps post outcome of Vienna talks.

MIDDLE EAST NEWS

- UAE to introduce first ever tax on business profits in 2023.

- Houthis warn of additional attacks on UAE after third attempted strike on Dubai and Abu Dhabi

- Qatar Emir visits the White House to meet with US President Joe Biden.

- Iran approves the opening of a Chinese consulate in Bandar Abbas, Iran’s main trading port.

- Syrian prison battle leaves hundreds dead and many Islamic State militants free.

- Israeli gas bridge to Turkey could ease the dependency on Russian and Iranian gas.

- Wave of political detentions, pursuit of activists in West Bank in Palestinian Authority (PA) crackdown.

- Israeli Defense Minister held a rare public meeting with Jordanian King Abdullah II in Amman.

- Saudi business group touts plan to improve economic ties with Russia.

- Kuwait takes lead in Gulf effort to solve Lebanon crisis.

- Gulf Foreign Ministers and GCC Secretary General visit China for talks.

COVID-19 OVERVIEW (GCC)

Four out of the six GCC countries (UAE, Saudi Arabia, Oman and Qatar) seem to have peaked with their Omicron infection numbers, while Bahrain and Kuwait are still seeing a rise in their numbers.

Active cases in the community for the majority of these Arab States are now in the tens of thousands at the end of January compared to the numbers (1,000-7,000 cases) seen at the start of January. The death rate in January has increased steadily across all six countries, from the sporadic, occasional, even long periods of no covid deaths, to 1or 2 deaths every day in January as a result of the rise in Omicron numbers across the Gulf Region. Despite both Kuwait and Bahrain having healthy vaccination percentages (86% & 102% respectively) in their communities, their active numbers have gone from 1,768 to 50,785 and 2,066 to 42,613 respectively over January.

While the milder symptoms and less debilitating effects (in majority of cases) of the Omicron variant, people testing positive still have to contend with a 10-day quarantine period unlike some of the European countries (5 days). Covid-19 restrictions remain in place, face masks are mandatory in public places. Visitors to these GCC countries require visitors to register online before travel, use their national Covid-19 mobile phone app on arrival and carry a vaccination certificate as back up (in the case of any local telecom network issues) to allow entry into certain establishments / venues within that country. PCR tests are still required for the return journey, making it impossible for same day business trips in the case of inter-Gulf business travellers.

Indicators suggest that for the majority of GCC countries the Omicron numbers have peaked and are gradually reducing whilst people continue to travel.

ECONOMIC GROWTH (SNAP SHOT)

Oil posts its biggest monthly gain in a year recording $91.70 and $88.84 for Brent crude and West Texas Intermediate (WTI) respectively, highs not seen since 2014. Geopolitical tensions (Ukraine, Houthi missiles and an Israeli visit) involving major oil producers Russia and UAE have helped drive prices up. Gulf economies continue to benefit from the oil price surge and even the presence of Omicron had little impact on visitor numbers to the UAE and Saudi Arabia. As the main Gulf economies push for more companies to go public, strong post IPO performances continue (UAE, Saudi Arabia & Qatar) and spark further interest from international investors (Goldman Sachs). Saudi’s Tadawul All Share Index up 8% this year, making it one of the world’s best performers (Bloomberg). Gulf sovereigns set to register stronger growth in 2022 off the back of easing economic restrictions in 2021, a direct result of high vaccination rates in the GCC (Fitch). Experts maintain that the introduction of corporation tax (9%) by UAE in 2023 will continue to attract foreign direct investment (FDI), international talent and global businesses. The introduction of Golden Visas gives all the right signals for attracting long term investment and money from taxation to support infrastructure growth making individuals and companies feel they belong.

SURROUNDING ARAB COUNTRIES

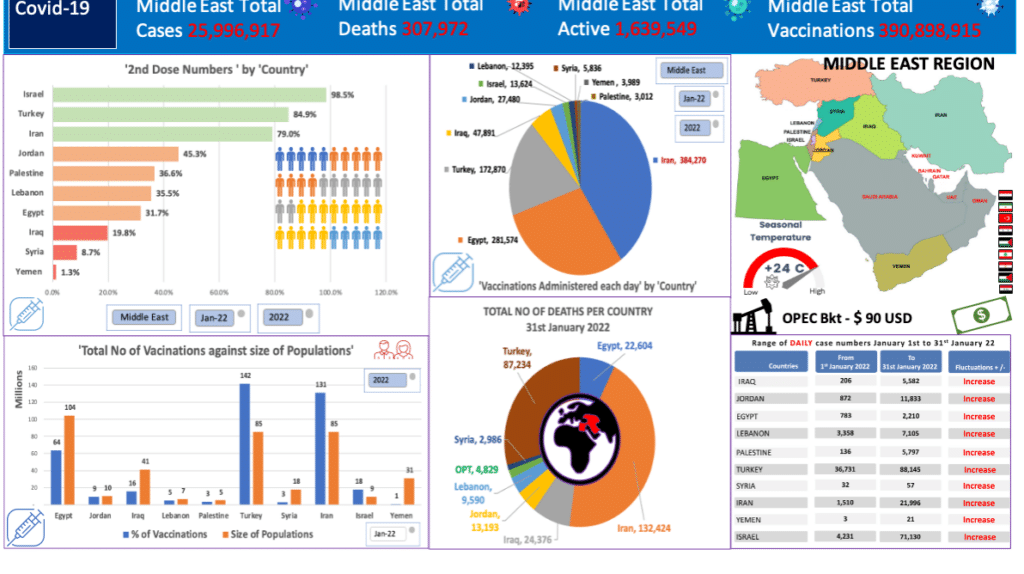

It’s the same Omicron story for the surrounding countries of the Middle East with all 10 countries regularly featured in this newsletter. Increases across the board as Omicron penetrates these communities as another Covid-19 wave drives the numbers up again. Accumulative active cases across these countries have risen by over one million in one month (490,517 in Dec, to 1,639 million in Jan), with Turkey alone accounting for over 600,000 of those numbers.

Turkey’s daily cases have doubled over the last month, with its death rate of just under 200 a day throughout January, the highest within this group of surrounding states to the GCC. Israel is another state to see a significant rise in active cases (441,148) and collective daily case numbers soaring from 4,231 at the beginning of the month to over 71,130 by the end of January. Lebanon is the next big increase moving from 47,430 active cases in the community at the start of January and ending up with 222,362 active cases at the end. Despite the doubling of Lebanon’s daily cases over January (4,500-9,000) the death rate still remains low at approximately 12 a day. Lebanon’s vaccination programme continues at a slow pace, with only 35.5% of its population vaccinated, a country still reeling from political, financial and security unrest.

Iraq still has some way to go with only a 19% of its 41 million population vaccinated and Omicron continues to drive the daily case number up from 4,921 at the start of 2022 to 73,996 cases at the end of January. Similarly, Iran’s daily case numbers have risen from 1,510 to over 21,000 at the end of January. Egypt still has one of the lowest percentages of population vaccinated in the group of ten (31.7%), sharp rises in new daily cases and deaths on the increase. Jordan’sdaily case numbers have risen sharply over the month, but its death rate remains relatively low. A relatively similar picture for Palestine and the data for Yemen and Syria, as you would expect, remains scant.

Omicron still has a significant hold on these countries. The virility of Omicron brings about a rapid contamination rate driving numbers up and with existing isolation periods, impacts on productivity and ultimately slowing economic recovery.