Introduction

The opening of Dubai’s $6.8 Billion Dollar Expo showcase with expectations of 25 million visitors over the next 6 months is a result of an unrelenting and determined vaccination programme. The development of individual state Covid-19 apps and various online vaccine registration platforms has been instrumental in enabling travel into the GCC countries both locally and internationally. Unlike Europe, strict virus protocols remain in some Gulf States and the wearing of masks in public is mandatory in all countries.

Oil prices in the high seventies, with forecasts alluding to a continuation of that trend in the short term, will continue to bolster the Gulf States fiscal recovery. Saudi Arabia continues to drive towards its 2030 vision with its Red Sea and NEOM projects and Qatar on track for the World Cup soccer series in 2022. The UAE, the second largest Gulf economy, is set for a continued gradual recovery however, the risk of a pandemic resurgence clouds the outlook for the Gulf States.

Both international and regional players line up to take advantage of the new regime in Kabul as the White House continues to administer its foreign policies from the side lines. The impact of the new Taliban 2.0 is still to be realized but this seismic shift will undoubtedly embolden regional militant groups. This is particularly concerning for Saudi Arabia’s plans as a regional power knowing the influence and longstanding relationship Tehran has with the Taliban. The normalization of Israeli-Arab relations in the Gulf States can only help counter the threat from Iran with its nuclear aspirations and influences as a regional powerhouse.

Geo-political (Snap Shot Middle East)

A month on from the western military withdrawal from Afghanistan, countries continue to line up to talk to the Taliban as governments across the region weigh up the risks in this diplomatic scrum. The Gulf States are cautious and particularly concerned about Washington’s reliability as a security partner across the region. This victory is a monumental shift of Geo-politics in this part of the world and will embolden jihadist groups all over the region and beyond Iran has managed to gain direct access to the new Tailban regime as have the Qatari government. Tehran have maintained relations with the Taliban since 2015 and will now strive to strengthen that relationship. Access to Afghanistan via western covert agencies will prove difficult and Gulf States such as Saudi Arabia grow concerned about Iranian influence, particularly among its proxy forces as this type of influence in Iraq clearly demonstrates. It is likely that the Saudis will indeed forge closer ties with Islamabad in a shared strategy in countering Iranian influence.

Russia, along with Pakistan, China, Iran, Turkey and Qatar were originally invited to an inauguration in Kabul, which would indicate a multitude of special relationships being developed by the Taliban. Lining up and engaging with these regional players will ultimately close the doors on US and European influences and leave the majority of Gulf States on the side lines.

Current Turkish-American relations are strained with a multitude of issues (Russian S-400 missile system, military campaign in Syria, gas exploration in the Mediterranean & F35 stealth fighter) widening the political gap. A fly in the ointment for the Biden administration will be Erdogan’s recent ‘behind closed doors’ meeting with President Valimir Putin. With no opposition left in Russia he need never explain his foreign policy decisions to anyone.

Iraq goes to the polls on the 10th of October and many are concerned these elections will once again see a low turnout. With an estimated 65% Shia and 35% Sunni split in the electorate many believe a prominent Iranian influence will remain.

Lebanon’s leaders have finally formed a new government ending at stalemate lasting over thirteen months. The complexity of Lebanon’s power sharing system will make the country’s recovery from a 90% loss in its currency value, half the population living below the poverty line and International monetary bailouts subject to colonial scrutiny, a long and arduous hill to climb.

Middle East News

- Dubai Expo 2020 hopes to mark the post-COVID transition for the UAE.

- 99% of Yemenis unvaccinated as virus spreads according to Oxfam.

- Ex-US intelligence operatives admit to hacking for UAE government, surveilling targets worldwide.

- Russia tries to leverage ties with Taliban in Middle East policies

- Iran’s Raisi to meet Putin as states mull Taliban recognition

- Iran continues demands for US forces to withdraw from critical airbase in Iraqi Kurdistan, with threats to expand operations against American and Zionist mercenaries.

- Iraqis go to the polls in early elections on the 10th October.

- Israel’s FM, Yair Lapid meets with Bahrani King, inaugurates embassy in Manama and visits a US warship in warning to Iran.

- Erdogan-Putin summit highlights Turkey’s fragile balancing act with Russian and US relations on the verge of collapse.

- Lebanon forms a new government led by Prime Minister Najib Mikatil bringing the 13-month deadlock to an end.

- Saudi Arabia seeks low key influence in Afghanistan in a move to protect its interests in the region and counter Iranian Influence.

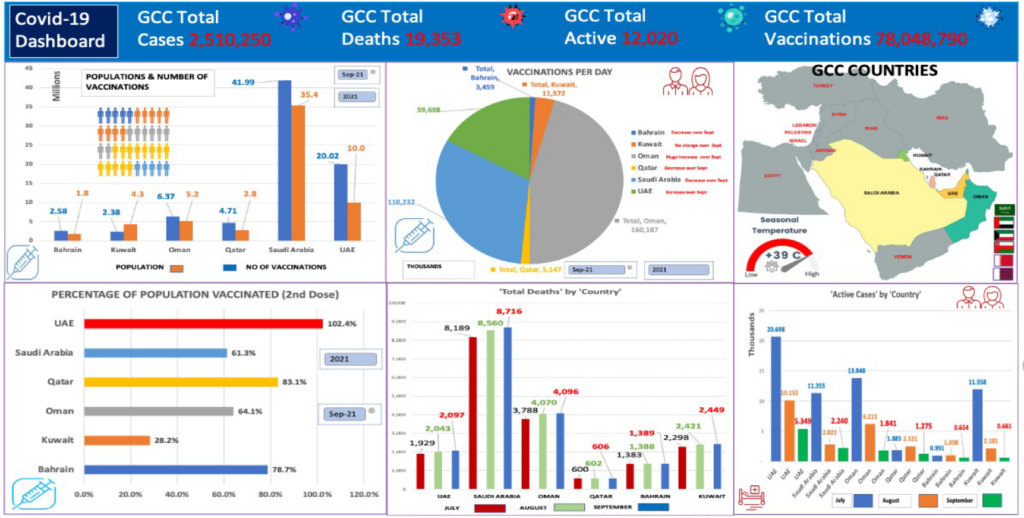

Covid-19 Overview (GCC)

The statistics speak for themselves as the GCC continues to administer Covid-19 controls within their own borders. The use of digital platforms, mobile apps, online registration portals for no-quarantine status and continued PCR testing for inbound and outbound travellers has been a vital ingredient to the continued success in controlling the pandemic and enabling visitors and business travellers to travel with confidence.

The UAE has seen a significant drop in its Covid-19 statistics in the lead up to the launch of EXPO 2020 in Dubai with its second dosage percentage now at 102.4% of the population. Oman has made significant progress in catching up with most other Gulf States with its vaccination programme now standing at 64%, up from 37.7% last month and continues to administer over 160,000 inoculations a day.

While five of the six coalition countries now exceed the two dose inoculation objectives beyond their total populations, Kuwait is still way behind the others with one of the lowest daily vaccination rates. All of the GCC states have managed to reduce the number of active cases in the community significantly month on month since July. All six countries have also substantially reduced their number of daily covid-19 cases over the last two months.

Despite the continuing virus countermeasure controls that the UAE has in place, it will be interesting to see how effective they are in the coming months, as millions of international visitors from around the world are expected to attend Expo 2020 over the next six months.

Overall the GCC continues to do particularly well in its fight against the pandemic, with oil prices benefiting the fiscal recovery and the associated cost of those countermeasures over the last 18 months.

Statistics are based on populations requiring 2 doses to eligable groups within those populations 2nd October 2021

Economic Growth (Snap Shot)

Economic prospects continue in a positive direction as the UAE anticipates 25 million visitors to Expo 2020 over the course of the next 6 months, Saudi Arabia benefiting from high oil prices, along with other states dependent on this revenue and Qatar’s expanding gas market.

Saudi’s 2022 spending cuts are seen as a positive development (Moody’s), Oman’s S&P upgrade credit rating to B+ is another positive and the UAE’s Central Bank announced it is expecting to see a 3.8% growth in its non-hydrocarbon sector. Israeli normalisation relationships continue to flourish both on a direct and in some cases indirect basis, particularly when it comes to Saudi Arabia. It seems all stand to financially benefit as Japanese SoftBank, considered one of the largest venture capital firms in the world, move to Tel Aviv. Dubai is a Hub for Japanese companies with approximately 350 companies present. Both the Saudi and UAE wealth funds (Mubadala) invest in SoftBank’s Vision 1 investment portfolio which include substantial investments in Israeli high-tech. The growing closeness between Israel and Abu Dhabi could bring the third largest economy closer to these Gulf States. The ever presence of Covid-19 will remain a high risk for the Gulf States.

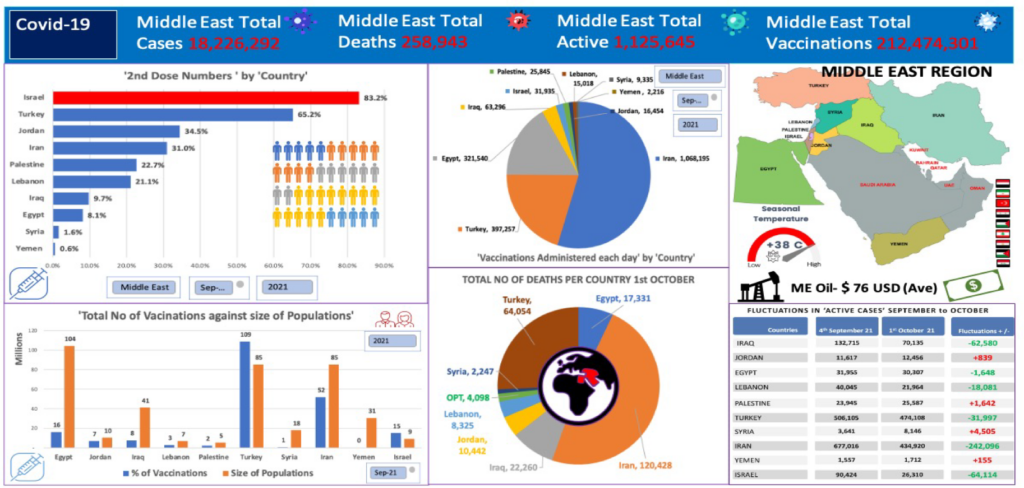

Surrounding Arab Countries to GCC

Iran continues to struggle with its fight against the pandemic. Despite the overall number of deaths (120,428), the death rate is coming down from its high of 700 a day in August to just under 300 in October. Despite the high number of active cases (434,920) only 1% remain in a serious or critical condition. It is throwing itself at its own vaccination programme, administering over a million doses a day to its population, but still has some way to go to achieve two doses of it total population.

Egypt is another country that has a long way to go with its vaccination programme with only 8.1% of its population vaccinated. Despite its daily efforts on the inoculation front (321,540), the active cases in the community are still remaining high (30,000+) while the death rate has been steadily rising over September (from 7-1st Sep to 39-30th Sep).

Turkey continues to throw a lot of effort behind its Covid-19 fight; the death rates are coming down, the number of critically ill active cases is 0.1% of a total of 474,108 who have mild symptoms. Iraq is suffering on several fronts and the fight against the pandemic continues to impact this country. It only has 9.7% of its 41 million population vaccinated and despite its comparatively low daily inoculation rate (63,296) in comparison to the size of the population, the active cases, death rates and number of daily cases are coming down.

The conflict zones of Yemen and Syria continue to struggle on all fronts, even with limited data coming out of those countries; Syria is seeing steep rises in the number of daily cases and active cases in the communities. Jordan is progressing with their vaccination programme (34.5%) and numbers across death rates, active cases and daily cases seem to show a plateauing effect.

Israel continues to push with its vaccination programme achieving 83.3% of second dose inoculations within its population and has significantly reduced its active case numbers from that of August (90,424) to 26,310, with only 1% of that number being critical.

Palestine’s vaccination programme continues on a strong footing (22.7%) whilst Lebanon is showing signs of a downward trend in its statistics.

Statistics are based on populations requiring 2 doses to eligable groups within those populations 2nd October 2021