Introduction

The continuing strength of oil prices and positive figures coming out of applicable non-oil sector areas of GCC economies comes as a strong indicator to continued economic growth in the region for 2022. The Covid-19 protection the Gulf States enjoy through their relentless vaccine programmes is set to benefit the likes of EXPO 2020, Qatar World Cup and the Saudi Arabian 2030 development project from tourists and businesspeople alike. The favorable climatic changes here in the Gulf together with the growing reputation of Covid-19 safe destinations will attract people wanting to escape the winter of the Northern hemisphere.

The UAE is seeing large numbers of visitors, in excess of pre-pandemic numbers, to the Emirates which will continue to aid its economic recovery.

While Arab governments in the GCC take a positive note from a slow but gradual economic recovery along with a well established Coronavirus control mechanism, they face another challenge going into 2022. This challenge is major geopolitical changes as a result of the regime change in Afghanistan, with regional and international players looking to seize and exploit the opportunities it presents. The Gulf States can ill afford to stay on the sidelines and need to match the vigor of engagement seen coming out of Iran if they are to counter this effectively.

The US back seat foreign policy of remotely managing Middle Eastern affairs is being exploited by the likes of China and Russia who are keen to exploit the natural resources and trade opportunities while old western alliances weaken. While long standing relationships hold strong in the Arab culture, western governments’ neglect of this region do so at their peril.

Geo-political (Snap Shot Middle East)

As the region continues going through major geopolitical changes, Iran remains at the forefront of that change. Its political maneuvering continues leveraging its relations with the Taliban as it hosts a conference with Afghanistan’s neighbours in Tehran. Foreign ministers from Pakistan, Uzbekistan, Tajikistan and Turkmenistan will attend. China will attend virtually, whilst Russia is also likely to attend virtually, despite having no land border with the state. China continues to expand its interests and influence in the region with a visit to Qatar to meet with the interim government of the Afghan Taliban. Pakistan is looking to remove Iran from its coronavirus travel restrictions list soon as both countries pledge to strengthen military relations in a recent visit by Iran’s army chief to Islamabad.

US-Iranian tensions remain high, with maritime military activity in the Gulf of Oman, US-flag burning by government loyalists celebrating the 1979 US Embassy take over and increased activity via its proxies in Yemen, Syria and Lebanon. In another defiant move to the West, Iran’s atomic agency announces a stockpile of 210 kilograms of 20% enriched uranium ahead of the nuclear talks in Vienna scheduled for the 29th of November.

To support the security of Gulf States in the region and counter an emboldened Iranian administration, the US approved a $650 million sale of advanced air to air missiles to Saudi Arabia and maintains a heavy maritime military presence in the Gulf of Oman.

Recent elections in Iraq resulted in significant defeat for the Fatah Coalition; a powerful alliance of pro-Iran militias helps with balancing the Iranian influence in the region however, this group will not accept this outcome without some sort of push back which could result in a round of sectarian violence.

Turkey steps up its military presence in Syria for a potential new incursion as the Turkish parliament extends the government’s mandate for military operations in Syria for another two years.

Israel continues its normalisation efforts with the Gulf States. The Israeli PM met with the Bahrani Crown Prince in Glasgow, Gulf Air and Emirates Airlines are flying regularly to Tel Aviv and Saudi Arabia work bilateral talks behind the scenes.

A Beirut protest organised by Hezbollah and the Shiite Islamist group Amal resulted in six dead and sixty-eight people charged. This relates to the arrest warrant for a Hezbollah allied minister tied to the recent port explosion, exacerbating the political and economic turmoil this country currently endures.

Middle East News

- Saudi couples flock to the Kingdom’s beaches as the Kingdom deals with fast paced social change. The Kingdom is open for business and tourists, in the context of rapid social change, which has some conservative Saudis anxious that changes are coming too fast.

- White House National Security Adviser Jake Sullivan discussed Saudi Arabia’s potential diplomatic ties with Israel during his meeting with Crown Prince Mohammed bin Salman.

- The Treasury Department issued fresh sanctions on Friday targeting individuals and companies the United States says are supporting Iran’s Islamic Revolutionary Guard Corps’ drone programme.

- An Islamic State attack has triggered a crescendo of acts of violence against and displacement of Sunnis in Iraq’s Diyala province, which borders Iran.

- The results of Iraq’s Oct. 10 parliamentary elections came as a shock to political parties affiliated with the Popular Mobilization Units, as they lost more than half of their seats in parliament.

- Turkey has ramped up military activity on the ground in Syria following a parliamentary extension of the government’s mandate to carry out cross-border operations.

- Six killed at Hezbollah protest: The shooting and its aftermath threatened to stoke sectarian tensions in Lebanon, which is also suffering a horrific economic crisis.

- Sudan: Moscow is interested in maintaining a military regime in power in the country, which is likely to show much greater interest in developing cooperation with Russia

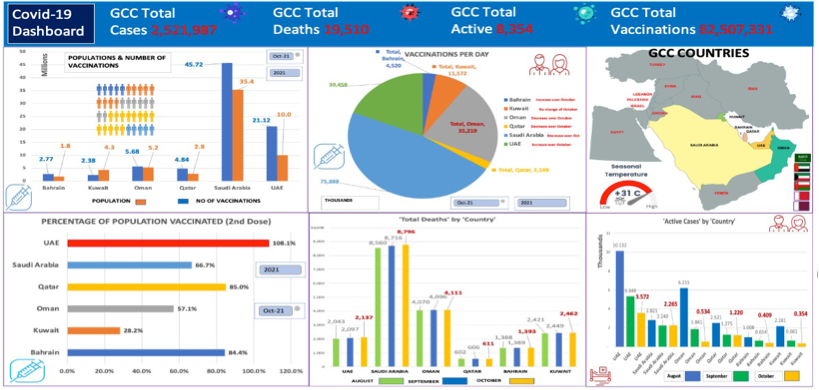

Covid-19 Overview (GCC)

Dubai has seen over 1.5 million visitors to the EXPO 2020 exhibition which opened on 1st October. The Financial Investment Initiative (FII) conference in Saudi Arabia was well attended by international companies. Similar numbers are now venturing into Qatar as they line up for the 2022 World Cup. While access across GCC borders vary, these countries have invested in technology, improving their immigration systems, particularly Saudi Arabia, using mobile apps displaying vaccination certification which have greatly improved movement within their own borders. PCR testing is made easy with hotel and home visits and results being delivered at no extra charge well within 12hrs. Same day inter-Gulf travel is difficult due to a PCR test certificate requirement to return back into your own country, making an overnight stay necessary in order to receive your PCR test results in time for your flight.

The GCC continues to effectively control the impact of the coronavirus despite the presence of the Indian strain and remains a safe destination to travel to for leisure and business.

Statistics are based on populations requiring 2 doses to eligable groups within those populations 2nd November 2021

Economic Growth (Snap Shot)

The GCC is faring slightly better than the rest of the world and these highly vaccinated countries enjoy a diminished threat of economic disruption as long as no new variants impact on vaccine efficacy. With OPEC+ agreeing to stick to their output plan, oil prices are set to remain in the high seventies/low eighties in the coming months. This continues to benefit GCC economies particularly those GDPs more reliant on healthy oil prices. UAE non-oil foreign trade grew 27% in the first half of 2021 ($ 245bn) and continues that momentum, particularly on the back of EXPO 2020. Saudi Arabia looks to China as part of its Public Investment Fund (PIF), China is the Kingdom’s biggest trading partner.

Israel and UAE continue to develop greater economic cooperation across a range of sectors and Emirates Airlines has announced daily non-stop flights to Tel Aviv. Qatar’s opening of its borders in July has seen a steady influx of visitors, as the Kingdom prepares for the FIFA World Cup in 2022. S&P Global Ratings is set to upgrade Oman’s sovereign grade for the first time since 2007 after improving its outlook to positive. The GCC continues its economic upward trend with continued growth into 2022.

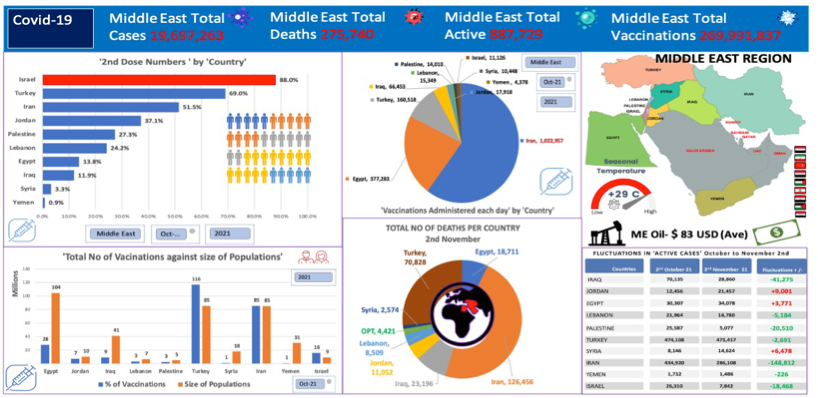

Surrounding Arab Countries to GCC

The surrounding Middle East countries to the GCC continue to struggle with their vaccination programmes as they drive towards that level of herd immunity status, with only Israel achieving this out of the ten countries featured in this Newsletter. Iran continues its aggressive push against the virus, inoculating over a million people a day in its fight to control the virus. It has moved from 16% of its population inoculated in August to 51.5% percent at the end of October. Surprisingly Egypt continues at a slow rate up from 4.75% in August to that of only 13.8% of its population vaccinated at the end of October. While Iran continues its inoculation efforts, Turkey has continued to cut back on its programme reducing its daily numbers from 600,000 plus back in August to only 160,000 plus in October, as it closes on that herd immunity goal of 75-80% of the population.

Iraq has marginally increased its daily inoculation numbers and has slowly moved its vaccinated population percentage from 4.5% in August to 11.9% at the end October. Despite the slow progress it has been able to control other statistics (daily cases, active cases & deaths) in a positive downward direction.

Fifty percent of these countries have seen a reduction in their daily infected numbers over September and October (Iran, Iraq, Occupied Territories, Yemen, Israel). Turkey and Lebanon have remained level over the same period, while Jordon, Syria and Egypt are seeing rises, particularly Egypt rising from 50 plus in September to over 900 plus a day in November. Consequently, their active cases have risen along with critical cases, with Jordon seeing 608 hospitalised critical cases.

Out of the two main conflict zones (Yemen & Syria), Syria is steadily making an improvement month on month with its vaccination programme moving from 2,500 plus a day to that of 10,000 plus a day, moving from I% of its population inoculated to 3.3% at the end of October. Yemen on the other hand continues to suffer from the lack of international help on this front, barely moving from 0.02% back in May 2021 to only 0.9% six months later (October). The majority still have a lot of work to do to get ahead of the pandemic.

Statistics are based on populations requiring 2 doses to eligable groups within those populations 2nd November 2021