INTRODUCTION

Despite the impacts to the global supply chain, the hike in worldwide interest rates, the threat of food security and fears of an economic slowdown for the region, the GCC countries continue to benefit from the current oil prices. The oil revenues give the main economies (UAE, Saudi Arabia, Qatar) the means to weather economic storms well and provide aid to regional countries in need. Despite their neutral, non-committal stance on the European conflict, aid is finding its way to war-torn Ukraine.

The state coffers of the Gulf States not only provides them with the ability to effectively tackle remnants of the pandemic head on but, in addition, provides them with the means to tackle the economic impact post pandemic and the effects of the European conflict. It also gives the big Gulf economies the opportunity to continue their global investments and diversification initiatives away from oil and gas dependency. The geo-political situation in the region remains complex, and an emboldened, prosperous Saudi Arabia continues its political maneuvering with its regional and international counterparts, against a weakened Iran (sanctions and Covid-19).

The UAE’s increased independent political prominence on the regional and world stage continues, as does Qatar’s, as all three drive their own aspirations of regional hegemony forward. Despite both the direct political and economic impact on Russia from the Ukraine war, it is not ready to let go of its foothold on the region as it looks to exploit every opportunity. The Gulf’s early aggressive stance against the pandemic, a well-established system of Covid-19 controls and various hybrid political systems that can turn countermeasures on and off when deemed necessary, are a major factor contributing to the Gulf economies.

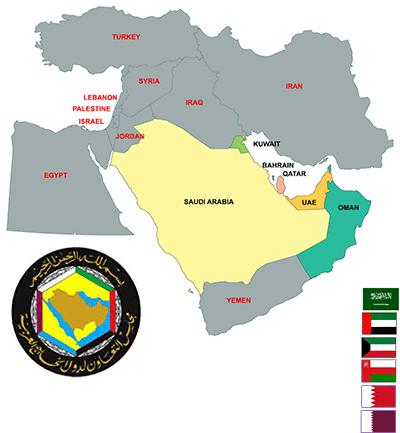

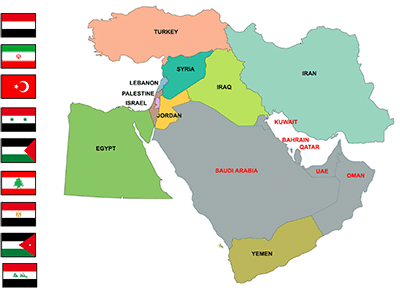

GEOPOLITICAL (SNAPSHOT MIDDLE EAST)

The US President Joe Biden is set to visit the Middle East in July, visiting Israel on the 13th/14th July and moving direct to Saudi Arabia to a Summit in Jeddah on the 15th/16th July. The GCC+3 Summit includes all six GCC Heads of State as well as Egypt, Iraq and Jordan. Both Biden and MBS (Mohammad bin Salman Al Saud, Crown Prince of KSA) will meet to discuss a wide range of topics (security, energy, food security and stability).

Despite the political turmoil in Iraq as Shiite parties make gains in Iraq’s parliament, Premier Mustafa al-Kadhimi continues his efforts in promoting dialogue between Saudi Arabia and Iran with a visit to both Jeddah (25th June) and Tehran ahead of the GCC+3 Summit. Iraq has hosted five dialogue sessions between the two rivals. The nuclear deal with Iran and the West continues to flounder despite recent indirect talks in Qatar (Iran & United States) and the Islamic Revolutionary Guard Corps (IRGC) continues to hassle US shipping in the straits of Hormuz. The Israeli Prime Minister is set to change in the coming week as per the incumbent coalition’s job-sharing arrangement for a period of four months before Israelis go back to the polls in November, for the third time in three and a half years. Jordan continues to forge political and economic relationships with Israel and Gulf States, particularly SaudiArabia, in an effort to curb its struggling economy, high unemployment (particularly young Jordanians) and rising debt post pandemic.

Egypt’s struggling economy also looks at alternatives and as the world’s largest wheat importer, Egypt and Russia are set to switch to local currencies (Ruble & Egyptian pound) to overcome Western sanctions. Egypt also looks to introduce the Russian payment system (MIR) to enable Russian tourists a payment method in Egypt’s Red Sea resorts. Similarly Saudi Arabia’s hegemony aspirations in the region is also set to benefit Egypt’s economy due of a number of agreements worth $7.7 billion. Turkey’s President Recep Tayyip Erdogan continues his foreign policy manipulation, gaining concessions from the West (NATO) as a result of his switch on Finland and Sweden’s membership. Visits by both the Israeli and Iranian Foreign Minister, within days of each other, one to thank him for foiling an alleged assassination attempt on Israeli citizens in Istanbul and the second, Iran maintaining the open-door policy for Iranians to travel to Turkey without visas. Iranian concerns with Turkey hinge on Ankara trying to limit Iranian influence in Iraq’s political sphere, selling Iraqi Kurdish gas to Europe via Turkey and Turkey’s planned military push into Northern Syria.

Despite objections from Washington, Bahrain is yet another Arab country that has recently established formal diplomatic relations with Syria (Bahrain, UAE, Oman, Kuwait, Jordan, Lebanon & Iraq). Yemen’s ceasefire continues to hold after two months.

ECONOMIC SNAPSHOT

Oil and gas producers continue to benefit from high oil prices (Brent $111) and regional importers will continue to look to the Gulf States for financial support. While certain GCC countries continue that support, these packages are now less generous and gone are the days of “no-strings attached” agreements. The lessons learnt (financial & political) from recent events (pandemic & Ukraine war) will see them looking for a greater return on investment as they look out for their own bottom line.

The World Bank’s projection for 2022 has forecasted growth at 2.9% for the Region, a significant reduction from its January estimate of 4.1%. Middle East central banks continue to tighten their monetary policies and raise their interest rates. This move includes Egypt and most Gulf States including Qatar, which will prolong a period of widespread sluggish growth and high inflation (stagflation). While gloomy big picture prospects exist, the three main GCC economies continue to prosper. Dubai’s tourism continues to grow with 6.17 million visitors from January to May 2022 and 24 million attending the EXPO 2020 Exhibition from October 2021 to March 2022. The looming World Cup in Qatar (November / December) is expected to produce equally good returns for the government’s coffers. Saudi Arabia’s economy continues to grow (10 year high), falling unemployment along with non-oil sector growth bolsters the Kingdom’s “2030 vision” investment projects.

MIDDLE EAST NEWS

- UAE to increase exports to countries in West Africa; the United Arab Emirates is one of the biggest investors in Africa.

- Syria-Bahrain ties continue to develop with bilateral talks, arrival of Ambassador.

- World Bank official: Lebanon, Yemen, Syria most food-insecure in region.

- Counterterror ops rake in ‘high-value targets’ in Iraq, Syria against Islamic State.

- IRGC Chief warns of spy war as new intel head takes over in Iran amid a shakeup following a series of breaches.

- Egyptian trade delegation visits Israel for first time in decade.

- Egypt, Saudi Arabia sign economic agreements worth $7.7 billion.

- In preparation for Biden’s visit, Israeli President meets with Jordanian king.

- Islamic Jihad ramps up the threats toward Israel in West Bank ahead of Biden’s Israel visit. Iran, Russia to establish trade centers focusing on energy trading and establishing a north south corridor of roads, railways and shipping lanes.

- Qatar gives cash-strapped Lebanese army $60 mn: announced by ministry in Doha.

- Israel says Middle East air defense partnership already in action.

- UAE sends plane carrying food supplies for Ukrainian refugees in Bulgaria, part of $5 million commitment.

- King Hamad and Egyptian President El Sisi open Bahrain’s new airport terminal, which is central to Bahrain’s wider tourism ambitions.

COVID-19 OVERVIEW (GCC)

There has been a mixed bag of Covid-19 data coming out of the GCC over the last couple of months. With the continued influx of visitors to the UAE we see daily case highs of 1700+ and a large number of active cases in the community (17,635). Bahrain and Qatar have shown continued increases, albeit small but on the rise all the same, with daily cases of 2008 from 600 and 739 from 250 respectively over June. As you would expect active cases in the community are also up (Bahrain AC-3,953 to 14,355 and Qatar AC-1,630 to 5,104). Deaths remain sporadic for UAE and Bahrain, with Qatar showing two in June having had nothing since March. Oman have had no daily cases since June 19th (52) with last reported number of deaths (3) were in April and active cases steady at 1,315. Saudi Arabia records a downward trend in its daily cases down to 759 a day from its June peak of 1,232 and this trend is again reflected in its slight fall in active cases (9,024). KSA with the largest GCC population (33 million) shows a steady death rate of 2/3 a day. Kuwait has seen fluctuating numbers of 400-500 daily cases over June and a rise in active cases in the community from 636 to 4,600. No deaths recorded since April 2022.

Three of the six GCC countries exceed 100% vaccination of their populations (UAE, Qatar & Bahrain), two others close to that figure of 100% with Saudi Arabia recording 97% and Kuwait 96%. Oman still catching up at 71% of its population vaccinated.Overall, the Gulf States have it under control, each country has its own Covid-19 phone app in use, online registrations into certain countries still exist, wearing of masks indoors within public spaces is still prevalent, as are PCR tests. Moving across several GCC borders in a single business trip requires research to stay up to date with Covid-19 changes.

COVID-19 OVERVIEW (MIDDLE EAST)

Out of the ten Middle East countries regularly featured in this Covid-19 Report (Iraq, Iran, Jordan, Egypt, Palestine, Turkey, Yemen, Syria, Israel and Lebanon) Israel has seen a recent rise in the number of daily cases (now at 15,928 a day) and active cases in the community at 73,958. Lebanon has seen a rise in cases from 235 to 1400, and active case at 15,466. Egypt’s data shows only 350 daily cases and 49 deaths since April, despite reporting current active cases at 48,850. Iraq’s numbers have seen a slight rise, Iran steady at 100-200 cases a day. Turkey’s last reported daily cases on June 26th (3,805). Yemen and Syria post sporadic data for June with last reported deaths on April 24th and 17th April respectively. Palestine records sporadic daily numbers in June (174 – 950) and one recorded death in May. Jordan continues to benefit from its hardline approach to the pandemic with only three small spikes since April and no deaths since May 1st. Most GCC countries have recovered from the Omicron onslaught of February 2022 but Israel continues to struggle.