Introduction

The GCC continues its fiscal recovery from the effects of the COVID-19 pandemic. Despite the presence of the Delta variant within the coalition, communities’ internal restrictions are being eased and people are starting to travel, particularly over the summer months.

From a vaccination perspective all these Arab states are progressing well. COVID-19 statistics in general such as active cases, deaths and the number of new daily cases have either plateaued or taken a gradual downward trend. However, the impact of the recent EID holidays is set to change that status quo. The UAE authorities are allowing its citizens and residents who had taken the Sinopharm vaccines at the beginning of the year, to now take either a booster or 2 doses of the Pfizer and AstraZeneca vaccines.

Geo-political events both within the GCC and the surrounding Middle East remain problematic. Events such as the US combat mission withdrawal, the nuclear rhetoric coming out of Iran, escalations in the hostilities in Yemen, a spiraling political and security scenario in Lebanon and the ever-present conflict in Syria will continue to impact on political, economic and security fronts across the region.

Recent talks between the UAE and the Saudi government are aimed at overcoming the OPEC+ rift that exists between the two countries. The price of oil continues to hold with prospects of continued improvement for all economies for Q4 2021 and into 2022. This increased level of profitability, albeit gradual, will undoubtedly see countries like the UAE, Qatar & Saudi Arabia provide fiscal assistance to other GCC economies, as we have seen in the past.

Geo-political (Snap Shot Middle East)

Iran will usher in its new president Ebrahim Raisi, who will inherit a plethora of problems on both an international and domestic front. The widespread internal protests by the populous regarding water shortages, electricity and the suspension of a controversial internet will the new transition. Nuclear talks in Vienna are not progressing and opposition to a US / Iranian deal from the incumbent government may be ruined by its hardline elements. Iranian influence in Iraq is set to increase as US combat troops leave the country. Despite this exodus, there will be a training and anti-terrorist capability left behind to help with the prevention of the reemergence of Islamic State in the Region. Western Oil and Gas companies will come under pressure to review their presence due to security concerns. China will obviously seize any opportunity on the back of any departures. The Iraqi administration continues to struggle on the COVID-19 front as they struggle with their pandemic countermeasures.

As a US military presence in the region continues to draw down, Afghanistan will be an increasing concern for the Arab States, with the likelihood of militant groups reemerging using its territory as a base being ever present. Turkey continues with its aggressive foreign policy efforts as it reaches out to provide security for Kabul’s International Airport.

The situation in Lebanon should be a concern for regional governments and international players. The political and economic crisis deepens, food rationing, fuel and water shortages and the presence of Covid-19 creates a dire set of circumstances. The emergence of another failed state in the region will only serve to provide a vacuum for militant groups and self-serving governments with the ability to exploit the country and its people.

Politics closer to home in the Gulf saw H.H Sheikh Mohammed, the Crown Prince ruler of the UAE visiting Riyadh to meet with Saudi’s Crown Prince, Mohammed bin Salman. The growing competitive rift between the two states stems from several issues; the UAE’s military drawdown in Yemen, the OPEC+ dispute, the Kingdom’s diversification plans or 2030, which includes plans for a second national airline going head-to-head with Qatar Airways and Emirates and the ban on UAE citizens and residents travelling to Saudi Arabia. These events align with Saudi Arabia’s sights set on becoming the dominant regional player.

Middle East News

- Senior US diplomats return to the Gulf in a renewed push for a ceasefire in Yemen as Houthi rebels resume cross-border attacks on Saudi Arabia after the EID holiday.

- US forces will end their combat mission in Iraq by the end of the year. Political parties aligned with Iran have demanded the withdrawal of all forces, playing into the hands of Iran’s long game. This could even open the country up to a reconstituted Islamic State 2.0 once again.

- Lebanon, with no medicine, electricity and fuel shortages and its currency collapse, estimates that half of its population can no longer afford enough food and people being forced into refugee camps in order to survive.

- As President-elect Ebrahim Raisi of Iran’s new civilian government readies himself to be sworn in next week, Ayatollah Ali Khamenei called the US ‘’stubborn’’ in the stalled nuclear talks in Vienna.

- As US and European combat troops exit Afghanistan, the Chinese Foreign Minister met with highlevel Taliban officials this week, underpinning China’s regional ambitions.

- Sheikh Mohammed bin Zayed of the UAE meets with Prince Salman in Riyadh in efforts to shore up the, dispute of OPEC+ policy setting. Economic competition is laying bare differences between the two countries.

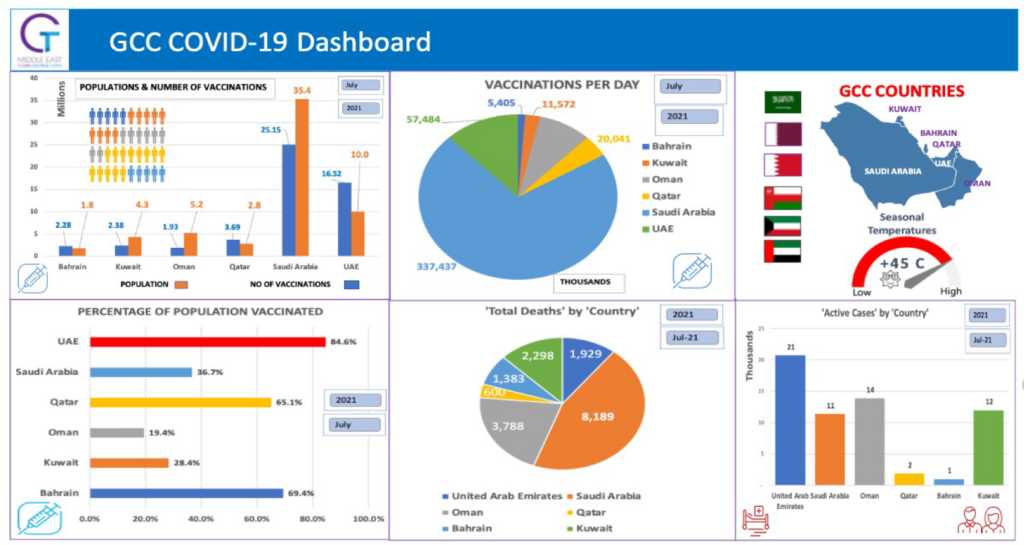

Covid-19 Overview (GCC)

As we head into the month of August, the GCC is seeing a slowing down and plateauing of its COVID-19 statistics (number of cases, active cases and deaths). However, we may see a spike in these numbers in the coming weeks due to the recent Eid Al Adha holidays (July 19 to 24th). Out of all the GCC countries, the UAE has seen a slow and steady upward trend in its active cases (21,000) due to both the holidays and the continual flow of people across its borders, while Bahrain has just over 1,000 active cases.

The vaccination programmes within the coalition countries continue, with Saudi Arabia delivering over 300,000 daily vaccinations in its attempt to catchup with the UAE, Bahrain and Qatar. Despite the World Health Organisation (WHO) recognizing the Sinopharm vaccine, several global governments do not; this has led to citizens and residents of the UAE taking 3rd and 4th vaccines (Pfizer / AstraZeneca) doses to enable them to travel.

The uncertainly over the effectiveness of the Sinopharm vaccine against the Delta variant would have also influenced the initiative. Saudi Arabia issued hardline travel measures for its citizens travelling abroad (red list countries), citing a three-year travel ban for people violating that government directive.

Recent epidemiological updates from the WHO confirms the presence of the Delta Variant in all six GCC countries. The percentage of people vaccinated in the population is based on two doses for each person. The death rates are down overall, ranging from intermittent cases of one/ two, through to twenty-five a day in Oman and fourteen in Saudi Arabia. On the whole, the GCC continues to do well in its fight against the pandemic.

Statistics are based on populations requiring 2 doses to eligible groups within those populations 30th July 2021

Economic Growth (Snap Shot)

Oil prices are up this year by 45% helped by the supply and demand controls set by OPEC+. This increase is expected to rise close to 60% in 2021 with continued growth into 2022. Fitch, the leading global credit rating agency, revised its Saudi Aramco outlook to stable from negative. This overall positive economic uptick will benefit the airline industry in the Middle East and across the world. The non-oil sectors across the three main GCC economies continue their expansion trends as the PMI remains on the growth side. The restoration of diplomatic ties between Qatar, Saudi Arabia, UAE and Bahrain have also benefitted local economies.

The cost of living in the context of CPI indexes for the GCC continues as previous months; the UAE, Oman and Bahrain remain in deflationary territory (-2%, -1.3%, -0.42% respectively) and Saudi Arabia, Kuwait and Qatar ranging between 6%, 3% & 2% respectively. Overall, all six GCC countries will see continued economic recovery on the back of the increased oil prices, with increased benefits to those Arab States with thriving non-oil sector economies.

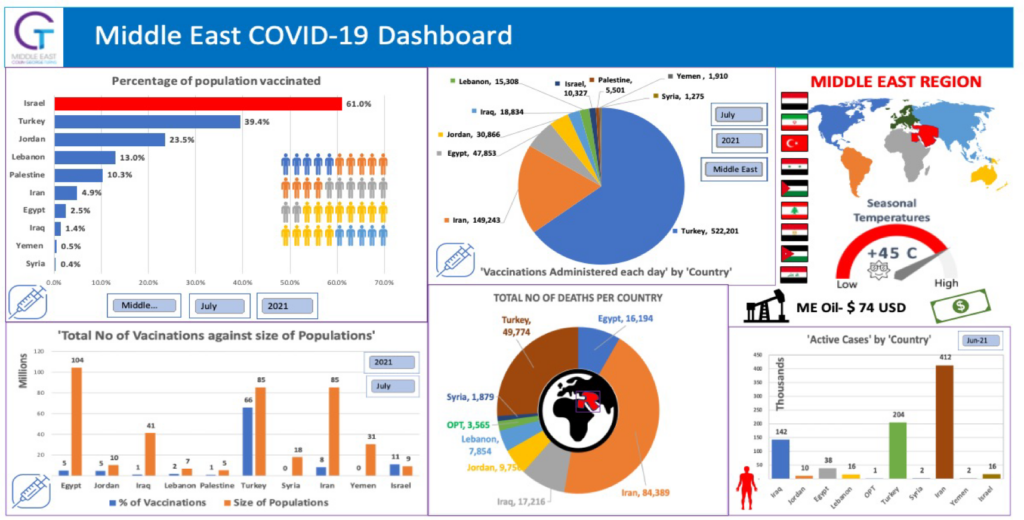

Surrounding Arab Countries to GCC

Israel pushes ahead with its vaccination programme, now including 12 to 16 year olds, in its fight against the pandemic and the Delta variant, with daily inoculations exceeding 10,000 doses a day. Turkey is seeing a surge in active cases in the community, which have doubled in the last ten days (85,000 to 171.000). This coincides with the increased number of reported cases and deaths. Despite this spike, Turkey pushes ahead with its vaccination programme achieving over 66 million inoculations to date (population 84 million).

Iran is experiencing a more aggressive surge, in the latter part of this month, in the number of new cases, active cases and deaths. Iran also continues with its vaccination programme.

Egypt is another country that is struggling with its vaccination programme, with only 5 million inoculations administered (104 million population). Despite these figures, the death rate had dropped below double figures, the active case count continues on a downward trend as do the number of daily cases.

Jordan and Palestine seem to have numbers under control, (either downward trends or plateauing) with regards to number of daily cases, active cases and low to sporadic death rates. They also continue to push with their vaccination programmes.

Lebanon has seen a fivefold increase in its daily cases (200 -1,000), which would account for the tripling of active cases in the community. Its death toll remains low (single figures) and just over 15,000 daily inoculations in its vaccination programme.

Iraq continues to struggle on all fronts, its vaccination programme having only delivered 1 million doses within its 41 million population. The active cases are soaring while the daily cases have nearly doubled in July (7,300 to 13,515), with a similar story with the daily death rates (40 to 80). The conflict zones of Syria and Yemen continue to struggle as expected.

Statistics are based on populations requiring 2 doses to eligable groups within those populations 30th July 2021