Introduction

The UAE is seeing a steeper rise in Covid-19 cases than this time last year due to the highly transmissible Omicron variant with rises in all other Gulf States. Despite another coronavirus wave firmly on the rise, the GCC remain in a strong position to fight the new onslaught with their high percentage of vaccination rates, ongoing booster programmes, ever present and long standing Covid-19 restrictions and the severity of non-compliance penalties will help shorten the recovery period significantly. Governments are more inclined to protect their economies by introducing lenient mobility restrictions, rather that restoring total lockdowns, particularly UAE, Qatar and Saudi Arabia, who have ongoing and up and coming commitments in the form of Dubai’s Expo 2020, FIFA’s World Cup in Doha and Saudi’s tourist and hospitality initiatives respectively for 2022.

Forecasters are still predicting economic growth for the Gulf region supported by gas and oil prices and production, continued vaccination progress which restores domestic activity and continual government structural reforms, despite the presence of Omicron. The region and the world wait to see what comes out of the nuclear talks in Vienna as an emboldened Iran seeks to leverage its position off the back of less committed Middle Eastern US foreign policy, a distracting EU focus concerning Ukraine and Russia and China’s continued opportunistic interests in the region.

The complex influences of Syria, Lebanon, Yemen, Iraq and now the horn of Africa (Ethiopia), together with Turkey’s economic struggles will continue to impact the whole region on several fronts, ranging from security, humanitarian, economic and climatic, as Syria and surrounding countries suffer the worst drought in 70 years.

GEO-POLITICAL (SNAP SHOT MIDDLE EAST)

Talks to revive the Iranian nuclear agreement in Vienna have restarted. US representation at these talks are being done through the UK, France and Germany (unofficially). Despite existing sanctions, Iran has continued with its nuclear enrichment programme. US, UK & the GCC want to see the Joint Comprehensive Plan of Action (JCPOA) restored, however, Iran continues with a harder line in its negotiations and wants the US sanctions removed. Recent Iranian military maneuvers with new weaponry in the Persian Gulf, drone sales to Ethiopia, Political meddling in Iraq and its antagonistic regional proxies, all form part of its forceful posturing. Israel will be particularly concerned with Iran’s current posturing, its historical non-compliance and continued enrichment and goals as a regional hegemonic power.

Continued waning US foreign policies in the region continue to embolden unlikely regional players who seek other alliances (China, Russia, Iran, Turkey) to counter their own security concerns, maintain power and seek financial gains. Iraq still remains in political deadlock and the annexation of certain Shiite factions rejecting election results back in October, will only look to continue military action against diplomatic missions and US military bases. The Organisation of Islamic Cooperation (OIC, second largest organisation to UN) met in Pakistan this month along with representatives from the UN and the EU to address humanitarian, financial and political issues concerning Afghanistan; highlighting that political isolation would only serve in establishing Afghanistan as a hub for terrorists and radical groups.

Lebanese face a worsening security and financial crisis, with emigrations soaring, particularly amongst Christians, which raises concerns in terms of demographic change. Tensions in Palestine continue to rise amid delayed reconstruction efforts by Israel in the besieged enclave of Gaza, whilst Hamas and Palestinian Islamic Jihad claim responsibility for the recent shooting attacks.Turkey continues to lose its grip on Syrian armed militias in opposition held areas as funding to these Turkish backed groups is massively impacted by the meltdown of the Turkish currency. The postponement of a fresh incursion against Kurdish Syrian groups will also deny these groups a new revenue stream and war spoils.

As Syria’s worst drought in 70 years, the Covid-19 pandemic, the collapse of Syria’s national currency and international sanctions, continue to drive impoverished numbers into the arms of ISIS who offer substantial sums of money to join their ranks. Despite Iraq’s declaration of the cessation of the US-led combat mission, some 2,500 US troops will remain as part of a multinational coalition to defeat Islamic State (IS).

MIDDLE EAST NEWS

- US concerned over Iran, Turkey UAE-supplied drones in Ethiopia war.

- Iran nuclear talks resume in Vienna.

- Iran vows to blow up Israel’s Dimona (nuclear facility) first if war breaks out.

- Gulf stock markets add listings, but foreign investors still skeptical.

- Qatar’s presence in eastern Mediterranean benefits Egypt, Turkey.

- Saudi Arabia seeks support as Yemen war heats up again.

- UAE signs $19 billion fighter jet deal with France.

- Iraq continues to kill and capture IS members as effectiveness questioned.

- Iraq announces end to US-led combat role with no fanfare.

- Currency crisis threatens Turkey’s Syria strategy.

- Lebanese opt for new emigration destinations amid crises.

- Violence in West Bank may lead to new confrontation with Gaza.

- Egypt ready to pump gas to Lebanon in the first quarter of 2022 via Syrian Gas pipeline.

- Kremlin hopes Syria can be a future thorn in NATO’s southern Flank.

COVID-19 OVERVIEW (GCC)

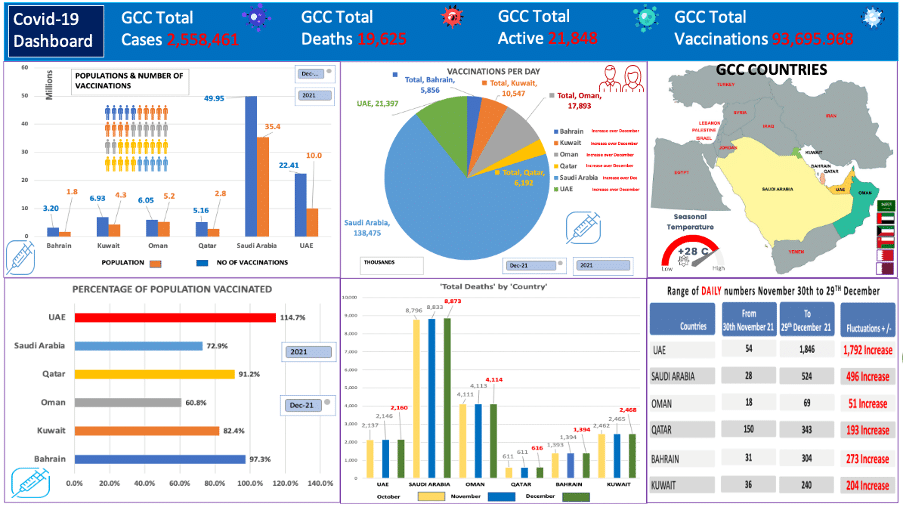

As the US and Europe see record numbers of the highly transmissible Omicron strain hitting their shores, the new variant continues to take hold of the Gulf States with the UAE seeing a significant rise in its Covid-19 numbers from 54 (1stDecember) to 2,234 (29th December). The remaining countries are also experiencing a fourfold increase in their numbers. Saudi Arabia has been pushing hard with their vaccination programme; this month up from 42,662 a day in November to 138,475 a day in December, pushing its percentage of population vaccinated beyond 72%. The remaining GCC countries have also increased their daily inoculations albeit not on the same scale as Saudi Arabia, but all have significant vaccination percentages of their populations, with most of them well into their booster programmes. The number of deaths is still sporadic and remain in single figures, critical cases and hospitalisations are low.

The main issues with rapidly rising numbers due to the highly transmissible strain are going to be disruptions to work force productivity (isolation periods), via its well-established compliance infrastructure, regional and international travel restrictions and the impact of the Festive Season, particularly for the UAE, which has large numbers of local and international visitors coming into the country and expats returning from around the world after Christmas. Even now, some countries are re-imposing certain restrictions (movement between Abu Dhabi and Dubai requires testing).

Despite the surge in numbers, it is expected that the high percentages of vaccination rates, ramping up of inoculations (boosters), continuing restrictions and Omicron’s reduced potency will be able to keep economic disruption to a minimum and see a sharper decline in disruption going into 2022 than the previous year.

ECONOMIC GROWTH (SNAP SHOT)

Overall financial indicators for GCC economies in 2022 show a strong recovery despite the previous lock downs and travel restrictions of 2021. The OPEC oil price has recovered slightly from its December 2nd low of $70.00 now up at $74.00. Oil prices are forecast to stay firm going into 2022 with breakeven oil prices set to decline for most GCC oil exporters and a healthy surplus assisting governments’ balance budgets. The non-oil private sector of the three main gulf economies (UAE, Saudi Arabia & Qatar) continues to do well. Their Purchasing Managers Index (PMI) has stayed well above the 50.0 mark for several months, which separates economic growth from contraction. Dubai’s Expo 2020 has another three months to run, Qatar has just finished FIFA’s Arab Cup tournament as a precursor to the Soccer World Cup in Doha 2022 and Saudi Arabia’ entertainment sector just getting started with over 8 million people having taken part in Riyadh Season 2021 in just two months.

Despite the threat of rising global inflation and the arrival of the Omicron variant, which brings about an air of uncertainty, the track record of GCC countries during 2021, both from a pandemic and economic perspective will undoubtedly maintain the momentum of positivity and determination going into 2022.

SURROUNDING ARAB COUNTRIES

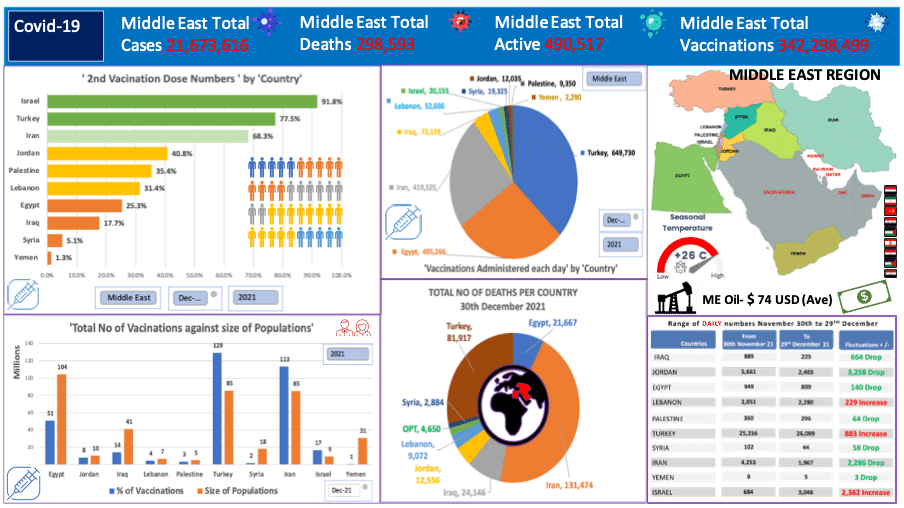

Just as Iran starts to see a significant slowdown in coronavirus cases (Sept 40,000 -Dec 2,400) and has massively reduced its active cases however, its first Omicron case was detected earlier this month. Iran continues to maintain a high rate of daily inoculations, albeit down from 525,388 in November to 419,525 in December with a population percentage of 68.3%.

Turkey’s daily inoculation rate has tripled over the last month taking its vaccination percentage to 77.5% however, its daily case numbers have risen from 17,000 mid-month to over 36,000 as of 30th December, as Omicron arrives in Turkey. Egypt is another regional country who is maintaining high numbers of inoculations, including boosters, in its attempt to raise the percentage of population vaccinated (currently 25%). The number of Egyptian active cases in the community continue to remain above 40,000 cases. Lebanon has imposed a three-week curfew for unvaccinated residents starting 17th December. Its daily case numbers have nearly doubled over December (1,800 to 3,400) and has a total of over 47,000 active cases in the community.

Iraq authorities approved the use of booster doses amongst concerns about waning vaccine immunity; Iraq has only 17.7% of its 41 million population vaccinated. Iraq’s daily case numbers have dropped from 700 a day to approximately 250 a day. Israel has seen a sharp rise in daily cases, has banned travel to the US and nine other countries, experiencing a surge in the fast-spreading Omicron variant and is also offering a fourth Covid-19 booster dose. While the numbers in Jordan’s daily cases have steadily come down over the month and have bottomed out around the 1,400 a day (26th Dec), they have now started to rise again.

Syria continues to struggle amid a collapsing health care infrastructure, with only 5.1% of its 18 million population having been given two doses of the vaccine, a statistic that doesn’t bode well in the face of the Omicron variant. Palestinian Covid-19 statistics have remained a constant throughout December (300 cases a day). Yemen remains in dire straits as the conflict intensifies, humanitarian issues escalate and a credible vaccination programme is non-existent with only 1% of its 31million people inoculated.Outlying Middle Eastern countries to the GCC brace themselves for the onslaught of the Omicron variant.