INTRODUCTION

As cases of the new Omicron variant appear in Europe and global markets react to its presence, the Gulf States will undoubtedly be gearing up to combat its arrival. While the pandemic countermeasures in the GCC are well established, the real risk lies with the poorer African countries as a source, potentially prolonging its grip on the world. Expo 2020 in UAE, Formula E in Saudi and the FIFA Arab Cup in Doha will be a channel to it establishing itself in the Gulf.

While the effects of established vaccines against this new strain is unknown and the probability of another round of lockdowns is uncertain, the strength of GCC economies and their economic recovery seen to date, albeit limited, will benefit governments and central banks in the fight against the Omicron variant.

If this variant is able to evade current vaccines, then this mutation could threaten the world and the region in coronavirus limbo.

The geo-political rhetoric in the region for the most part has been migrating in a positive direction over this last quarter however, the next round of nuclear talks in Vienna are a pivotal point for foreign policy changes, both internationally and locally, if progress is not made. Government elections, the effects of the pandemic, situational exploitation by militant groups, water and fuel shortages, refugees and two civil wars at both ends of the Arabian Peninsula are a continual strain on progress.

The complexity of this region can have a stalling, neutralizing effect on agreements, accords, aid packages and the likes and the strong leadership shown to date by a number of GCC States will certainly be tested in the coming months. The international players (USA, China and Russia) and their agendas considerably add to that complexity.

GEO-POLITICAL (SNAP SHOT MIDDLE EAST)

As 2021 comes to a close, Iran continues its political dialogue with regional players ahead of Nuclear talks in Vienna (29th November), the outcome of which will undoubtedly shape the geo-political landscape in the region moving into 2022.

Iran and UAE have agreed to usher in a new chapter in their relations during a visit to the UAE by the Iranian Deputy Foreign Minister. Saudi Arabia’s talks with Iran are set to continue as both sides are allegedly committed to engagement. The four previous rounds were merely “exploratory”, with a further round of talks expected soon. The removal of Iran’s military forces Commander from Syria, General (Javad Ghaffari) is seen as a move to maintain relations between President Assad and Tehran.

Islamic State entrenched as a low-level insurgency in Iraq and Syria, regional economic hardships, Covid-19 and a devastating drought especially in Syria continues to shape the landscape. Iranian backed proxy forces are still a threat and Syrian and Iraqi counter insurgency efforts continue to depend on US support and training.

US envoy to Iran Rob Malley recently visited the UAE, Israel, Saudi Arabia and Bahrain to discuss the up and coming talks in Vienna. US Defense Secretary (Lloyd Austin) also visited the region to reassure Middle Eastern officials amid concerns of Russia and China’s inroads in the Gulf.

Political deadlock in Iraq following Iraqi elections in October will probably end as a consensus government. The recent assassination attempt on the PM and the call up of Iranian linked militia volunteers to fight US forces remaining after December 31st will continue to raise the threat of violence.

The endemic political and economic corruption in Lebanon is ever present and Hezbollah continues its dominance with efforts to block the Beirut port explosion enquiry to shield its politicians and officials from scrutiny.

The Turkish President met with MBZ (UAE Crown Prince) in Ankara ending years of hostility as the UAE will invest up to $10 billion in Turkey’s increasingly shaky economy, as the lira loses 42% of its value against the greenback in 2021.Egypt recently hosted the Arab Intelligence Forum, which was attended by several regional intelligence services to discuss various regional issues, one of which is welcoming Syria back into the Arab League. A move that would not be welcome by Turkey, Iran and Israel. Despite the cordial rhetoric, regional political chess players will continue to keep the Iranian chess piece contained on the Middle East chess board.

MIDDLE EAST NEWS

- US Treasury amends sanctions to ensure aid agencies can deliver humanitarian assistance in Syria.

- Iran and the United States are upping the ante in the Gulf ahead of a planned return to negotiations in Vienna.

- Saudi Arabia’s move to license 44 companies to open their Headquarters in KSA, has put the Kingdom in competition with the United Arab Emirates as a regional business hub.

- Qatar will formally represent US diplomatic interests in Afghanistan to facilitate Washington’s engagement with the new Islamist rulers.

- UAE, Israel, Bahrain and US conduct joint naval exercises in the Red Sea.

- Israel calls on Ankara to close Hamas offices in Turkey after killing Eliyahu Kay in Jerusalem, following West Bank cell led by Hamas Turkey office.

- US, Israel divisions on Iran as Israel worries over Americans heading to an interim agreement with Iran, wiping away sanctions.

- Head of UN Iraq mission tells Security Council no evidence of election fraud.

- The Palestinian Authority seeks Putin’s help to revive Israeli-Palestinian peace process.

- Egypt, Qatar agreement with Israel provides boost for Gaza economy

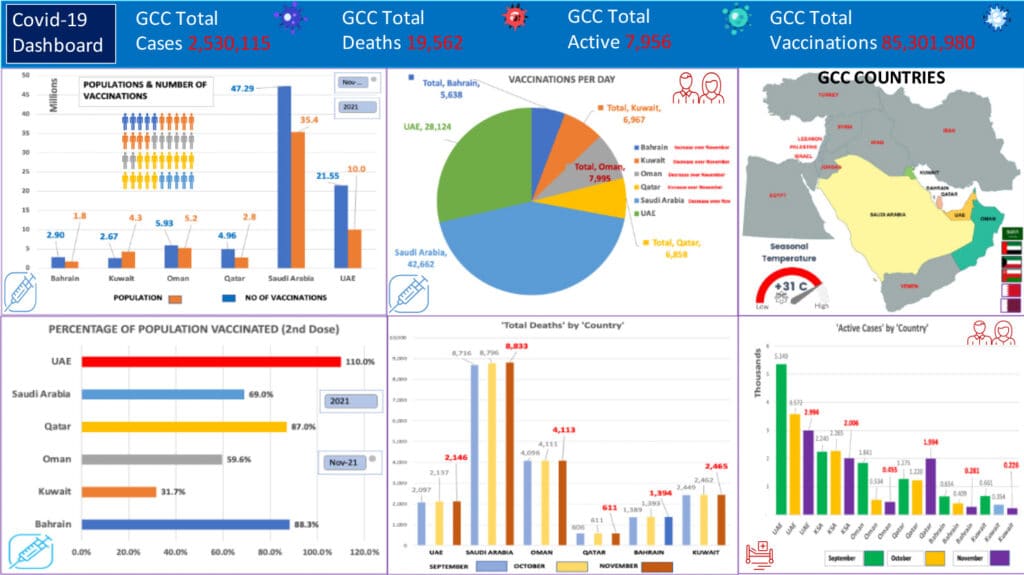

COVID-19 OVERVIEW (GCC)

The steady progress of vaccination programmes and the drop in daily infection rates and active cases in the community together with the low Covid mortality rates across the Gulf States is reflected in the lowering of daily inoculation rates for most GCC countries. Qatar is the only one that has doubled in daily rate from 3,249 in October to 6,858 in November. While Qatar’s death rate has not increased in two months, there have been a gradual increase in the number of daily cases since mid-October as well as active cases. All but Kuwait have reached 60% or greater of their populations vaccinated. Kuwait has continued with less than 15,000 inoculations per day for several months and will undoubtedly remain below 35% going into 2022 given its rate of progress.

While Gulf States have protocols in place with regards to the wearing of masks in public, vaccination authentication on entry into establishments/venues, use of Covid phone apps and online vaccination registrations, the policing of some these aspects vary greatly from country to country. The Covid protocols communicated on official websites can vary once on the ground. A recent business trip to Bahrain highlighted several issues. Firstly, you must self-isolate, in my case the hotel, until you receive the results of a mandatory PCR test on entry to the Kingdom and secondly it took over 24hrs to receive the results.

Business people with corporate phones with strict cyber security protocols will have difficulty connecting to most Covid-19 apps and carrying a printout of your vaccination certificate is a must to satisfy most hotel and restaurant security staff to gain entry. Most hotels and clinics can turn around the PCR tests quickly and range between 6 to 12 hours, at a cost.

ECONOMIC GROWTH (SNAP SHOT)

The UAE is open for business once again, passengers coming into Abu Dhabi are tested for COVID, with results ready by the time they reach customs. Dubai Expo 2020, Dubai Airshow and a number of strategic conferences continue to boost tourist numbers. Saudi Arabia announced that 44 multinational companies would move their regional Headquarters to Riyadh and according to Bloomberg, the Saudis are talking to some 7,000 companies around the world. Bilateral trade between the UAE and Israel has reached 700 million USD since the Abraham Accord.

UAE, India, Israel and the United States formed a joint economic forum. While the non-oil sectors in the GCC prosper, not so for the price of oil as the news of a new virus variant triggered oil’s worst crash in over a year. Opec+ meets on December 2nd to decide 2022 output policy, along with the significance of the variant on the market. Overall, economists continue to forecast GDP growth for the GCC at between 3% to 5% in 2022. Despite the concerns in Europe of the new variant across its own borders, the GCC is well placed to counter this new threat with well-established effective countermeasures that protect the populations as well as their economies.

SURROUNDING ARAB COUNTRIES

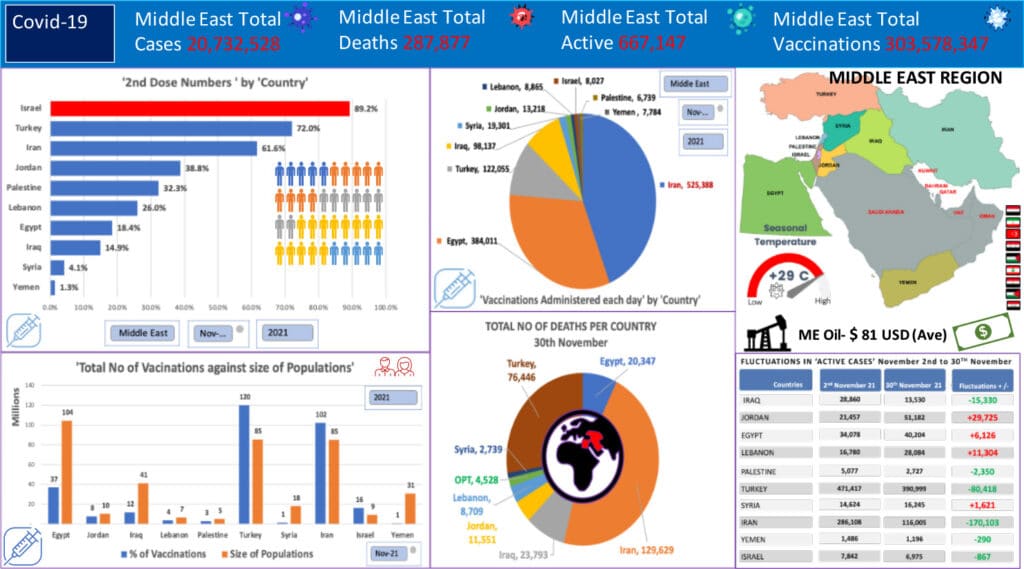

Turkey is still fighting to control its Covid-19 numbers, with over 25,000 daily cases, over 390,000 active cases in the community despite it achieving a 72% two dose inoculation ratio of its population. Iran is another Middle East country that has been slow to bring its numbers under control from the highs of late August, with its inoculation programme at 61.6% per cent of its population vaccinated with two doses. Its inoculation programme is still running at over half a million doses a day administered. Despite Israel achieving herd immunity levels back in August, it is only now getting to grips with the third wave as of September this year.

Seven of the ten countries featured in this Newsletter still remain below 40% of the population with a two dose inoculation level, four of which sit below 20%, surprisingly Egypt being one of them. Egypt’s Covid-19 daily cases run below 1,000 a day but they have over 40,000 active cases in the community and deaths are starting to ease around 50 a day. Jordan has administered 8 million doses against its 10 million strong population but despite its efforts can only inoculate 13,218 cases a day. It has over 51,000 active cases in the community and death rates are on the climb.

As the data indicates some countries woefully lack the infrastructure and capacity to deliver the numbers required to stay ahead of the evolving variants of the pandemic. The two war torn countries of Yemen and Syria have not reached 2% of their populations vaccinated ten months on. For the most part, the death rate across the region has slowed, with most countries ranging between 50 to 10 deaths a day. Turkey and Iran with the larger populations, are however seeing between 150 to 200 deaths a day.

Overall, the region continues to struggle particularly with its vaccination programmes and large numbers of active cases in over 50% of the countries featured. The emergence of yet another variant (Omicron) will undoubtedly impact its recovery well into the early part of 2022 and most countries will remain vulnerable if inoculation programmes remain at the rate we have seen over the last six months.